See the "Help" box on the upper-right of the screen for more information about each entry.ħ. Enter the information from your paper form in the corresponding spaces on the 1099 form screen.

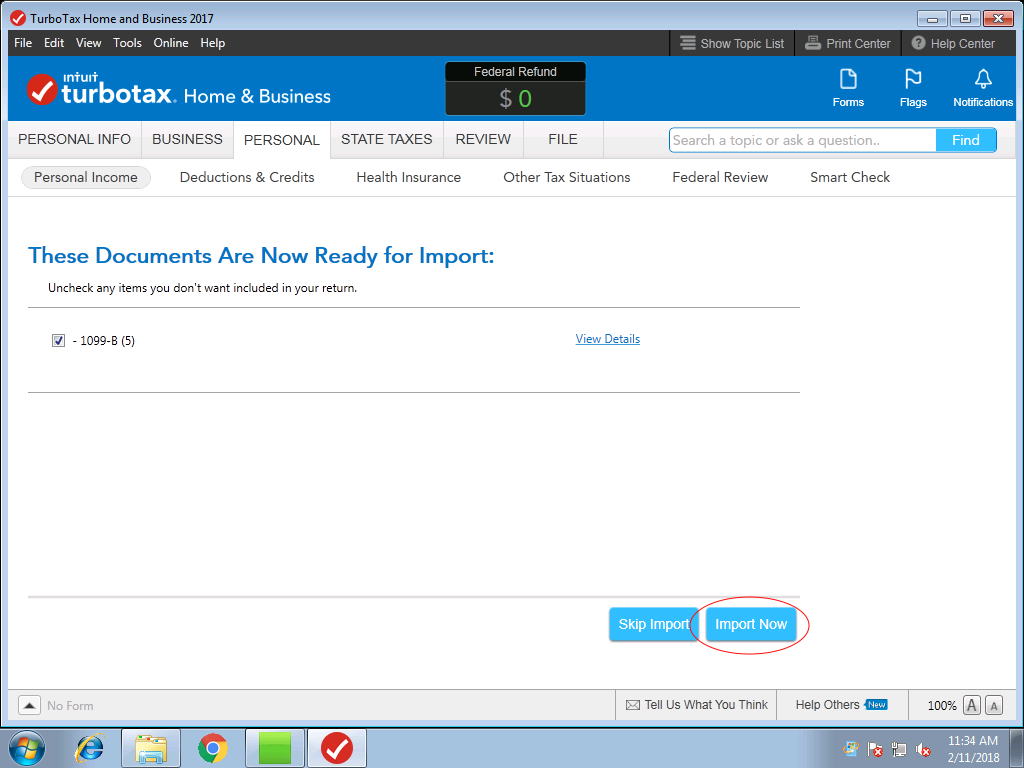

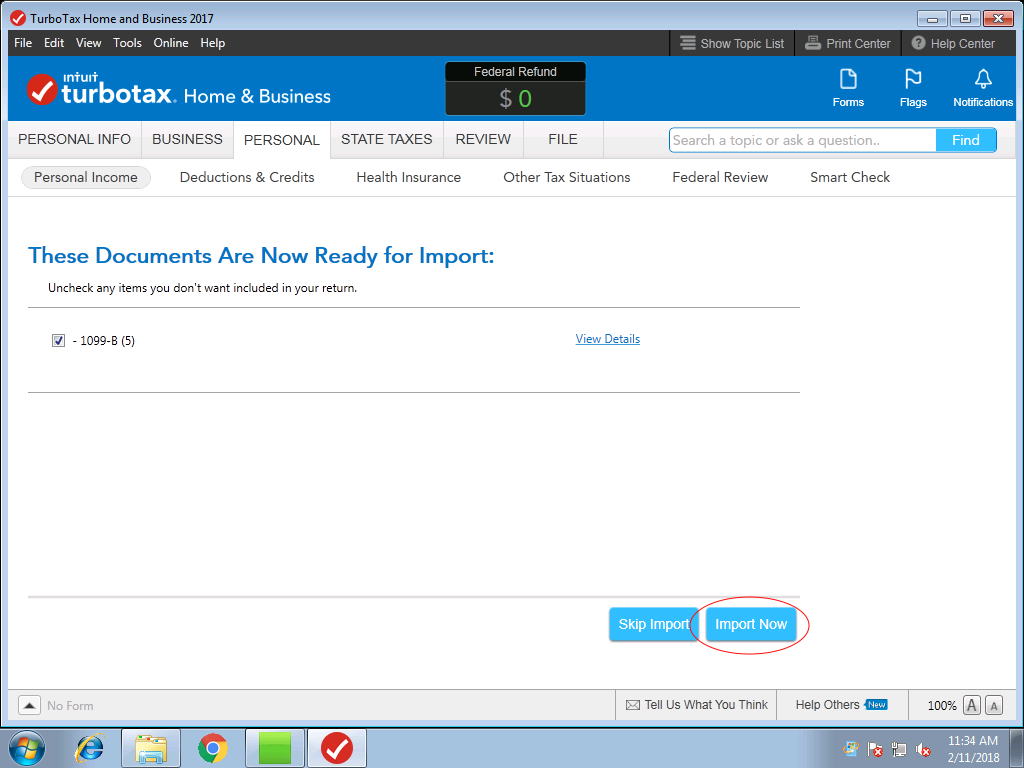

8889 - Health Savings Accounts (complete form using 1099-SA info).Ħ. 1099-RRB - Railroad Retirement Benefits. 1099-R - Pensions and Retirement Plan Withdrawals. 1099-OID - Interest Income - Schedule B. 1099-G - Unemployment, Tax Refunds and Other Government Payments. 1099-B - Stock Transactions and Sale of Assets. Listed below are the 1099 forms we currently have on : View the list of 1099 forms below the search box and click the "Add form" button next to the form name you have. Scroll down to the "Search for federal forms" search box and enter 1099 in the box.ĥ. Click the "I'd like to see all federal forms" link to find a list of federal tax forms.Ĥ. Click "Review" on the left menu below the "Federal Taxes" heading.ģ. Log into your account and click "Federal Taxes" on the left menu.Ģ. Note: The instructions below contain images and are not interactive.ġ. Following the interview allows the platform to go through each section so you do not miss anything. This will walk you through all the kinds of income, guide you through specific questions based on your situation, and help you claim tax deductions and tax credits.

The simplest way to report this form is by beginning the tax interview when you sign into your eFile account. Additionally, it will calculate the various tax figures and enter your income in the right lines of your 1040 Tax Return. The app will select the correct tax forms for you and help you complete them.

If you have income reported on a 1099, you won't have to worry about what forms to fill out and where to enter your 1099 numbers on. A W-2 reports income you earned as an employee, but many other types of income are reported on a 1099 form. Income information is provided to you on various forms, such as a W-2 or a 1099. When you prepare your tax return, you will need to report all of the taxable income you have received during the tax year. Generally, sales that generate you a profit and cash exchanges for goods and services are subject to this rule. This is because the IRS lowered the issuing threshold from $20,000 to $600 for transactions beginning on January 1, 2022. You may be issued a 1099-K unexpectedly for transactions made on platforms like Venmo, Cash App, or sales on eBay. These forms are all used to report different types of income.

There are many different kinds of 1099 forms, each of which is designated by one or more letters (such as 1099-K or 1099-MISC). The payer sends the proper 1099 to the IRS and a copy of the form to you.

HOW TO IMPORT 1099 INTO TURBOTAX FREE ONLINE HOW TO

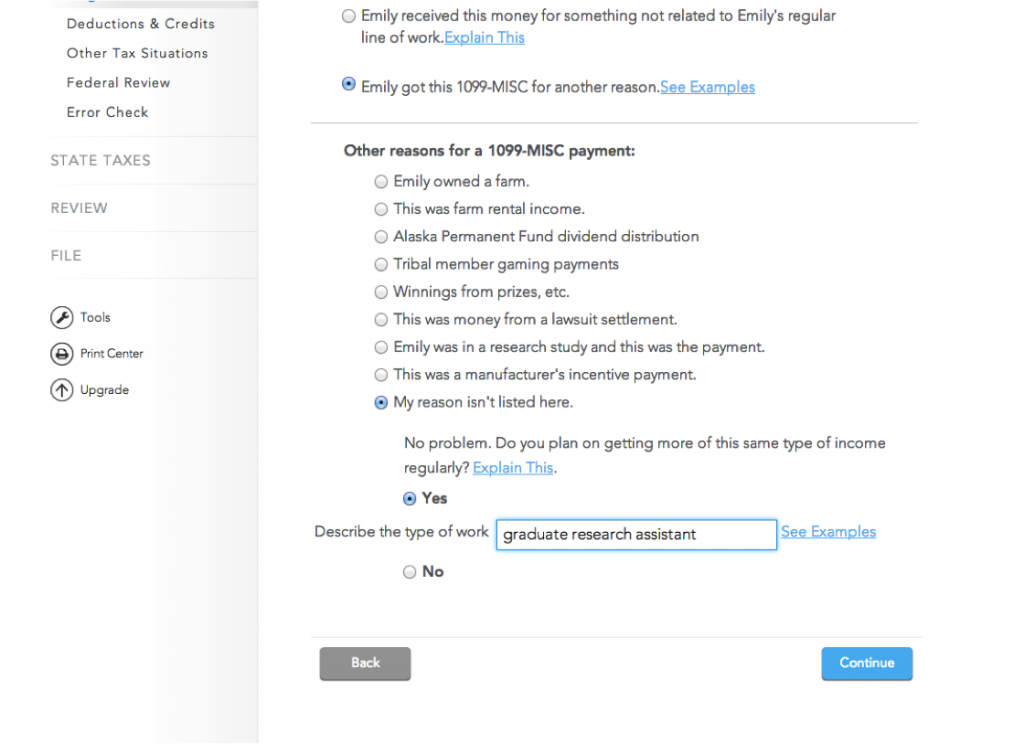

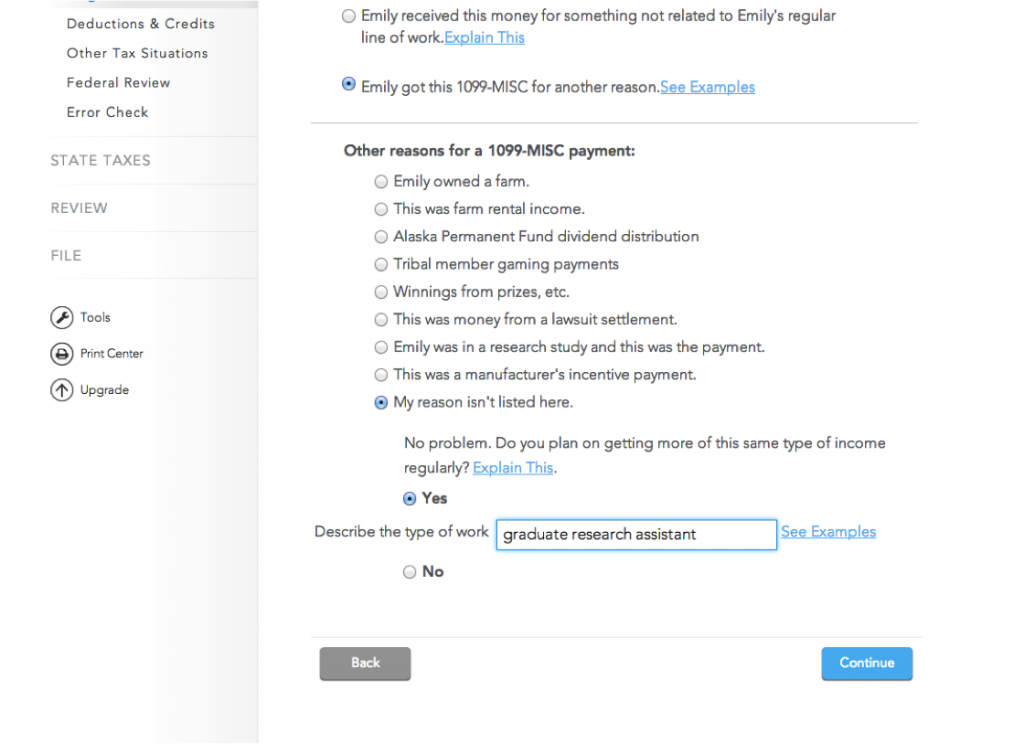

How to enter 1099 information on ?įorm 1099 is a tax form that is used to report non-employment income that you received which needs to reported on your tax return. To find out what a 1099 is and what to do with it, review the following sections: These forms are all supported on, meaning only a few figures need to be entered from the form so the eFile app can calculate the various tax values and report them on the IRS and state tax forms. There are many kinds of 1099 forms issued for various types of income, such as certain retirement income, self-employment income, or dividends and distributions. eFile will ask you specific questions regarding your income before indicating which 1099 or other income form is needed. When you prepare your 2021 Tax Return on, the app will guide you through entering your 1099 form information based on your answers to several questions about your tax situation. There are over a dozen 1099 forms, so you may be wondering how to report your specific 1099 or multiple 1099 forms. Okay, here's the situation: it's tax time and you're going through all the tax documents you received in the mail before coming across a Form 1099. How to Prepare and File a Tax Return with a Form 1099. We have divided the topic of 1099 forms up into three pages:

0 kommentar(er)

0 kommentar(er)